How events affect hotel rates: what Radiohead and the Winter Olympics can teach you

Learn how to properly estimate event impact and sell your rooms at the most profitable rate.

What impact do events have on hotel and vacation rental prices? Looking back, it’s easy to tell: just check the data.

At the end of October 2025, Lucca Comics & Games sent hotel prices soaring to five times their usual levels, while short-term rental prices tripled.

A month later, during the Davis Cup Finals in Bologna, the average hotel room price increased by 40%, and apartments climbed by an average of 22%.

These are just two major examples of large-scale events in Italy with strong national appeal. But every year, thousands of concerts, festivals, trade fairs, and even small local happenings create sudden spikes in demand in the destinations where they take place.

For property managers, these moments are a valuable opportunity to boost occupancy and grow revenue. But to capture that value, it’s not enough to adjust rates based on gut feeling. You need to react at the right moment, and above all, be able to correctly estimate the potential impact of each event.

Let’s take a look at some useful guidelines to help you get it right.

It’s not about how big the event is, but how much it impacts your market: the Radiohead example

Many hoteliers judge an event based solely on its importance or “size.” In reality, you also need to consider how far it is from you and how much accommodation supply exists around your area. A clear example is Radiohead’s European tour in November and December 2025.

The announcement came out of nowhere and, within just a few weeks, search demand exploded. But the effect wasn’t the same everywhere: the fewer rooms a city had available, the faster the curve spiked.

Bologna, with fewer than 10,000 rooms in total, was hit the hardest. Two months before the concert, accommodation searches were already up +73% compared to the same period the previous year, while prices had increased only +44%. Demand was racing much faster than rates—a clear sign that many hotels hadn’t reacted yet.

In Copenhagen, a larger market with roughly 25,000 rooms, the effect was noticeable but softer. Two months before the show, 45% of rooms were already sold, but rates were up only +10%. Demand was growing, but the deeper supply helped absorb the pressure on prices.

In major capitals like London or Madrid, however, almost nothing moved. With more than 150,000 rooms available, supply is so large that even high-profile events fail to generate meaningful spikes in searches or prices.

Steps to correctly assess an event’s impact

This example highlights the steps you should follow to measure an event’s impact more accurately—without underestimating or overestimating it.

1.Check the supply around you

If there are only a few thousand rooms available within a short radius, even a medium or small event can trigger a sharp rise in demand.

2.Check how close you are to the event venue

The closer (or better connected) you are to the location, the more attractive your property will be for guests.

3. Monitor market occupancy, not just your own

If availability in your area is dropping quickly, demand is moving, and it’s time to adjust your prices.

Looking at OTAs isn’t enough to understand market trends before an event

As an event approaches, many hoteliers do the same thing: they open Booking.com or Airbnb to get a sense of prices. It’s an instinctive move, but one that can easily mislead you.

Take the Milan-Cortina 2026 Winter Olympics, for example. Prices for accommodations have already jumped significantly, but many of the listings in Cortina costing thousands of euros per night on Booking.com are tagged as “New.” That’s a clear sign that plenty of people are trying their luck as makeshift hosts.

The same thing happened during Rome’s Jubilee Year, which showed just how distorted a market can become when decisions are based more on wishful thinking than on actual data.

Many hosts improvised, or inflated their prices based on a “this should work” mindset — without considering who was actually traveling or how saturated the market really was. The result? Lower-than-expected occupancy and disappointing revenue.

If you want to dive deeper into how to analyze the market, check out our article on how to monitor competitor prices and occupancy in hotels.

How to read the market correctly (without being fooled by OTA prices)

To truly understand how the market is moving before an event — and avoid being tricked by overly inflated prices online — focus on these checks:

1.Monitor real demand, not listed prices: What really matters is the increase in search volume, which always comes before bookings.

2.Check how quickly supply is shrinking in your area

If available rooms around you are disappearing fast, it means demand is genuinely on the move.

Want to check your rates for 2026? Do it now, for free!

How to monitor events and adjust your prices with Smartpricing

So far, we’ve seen how complex it can be to take advantage of a local event.

To do it properly, you need to:

- identify event dates immediately as soon as they’re announced,

- estimate the impact each event will have on your market, and

- regularly monitor occupancy trends — both yours and your competitors’.

While the first two steps can technically be done manually, monitoring market-wide occupancy is much harder (if not impossible) to do on your own.

To make sure events are correctly included in your pricing strategy, you can use a tool like Smartpricing, the dynamic pricing software by Smartness.

Smartpricing includes automatic event monitoring directly in its algorithm. The system scans the local event calendar through ticketing and reseller platforms, evaluates the impact, and adjusts your prices automatically.

The algorithm considers each event based on its importance, its distance from your property, and the density of accommodations in the area.

With this information, it calculates the percentage impact the event will have on your prices and adjusts them accordingly, up to 500 days in advance.

This means you can already start selling your rooms at the best possible rate, even for events that have been announced but are still far away.

As the event approaches, the algorithm keeps optimizing those rates based on both your occupancy and your market’s occupancy trends.

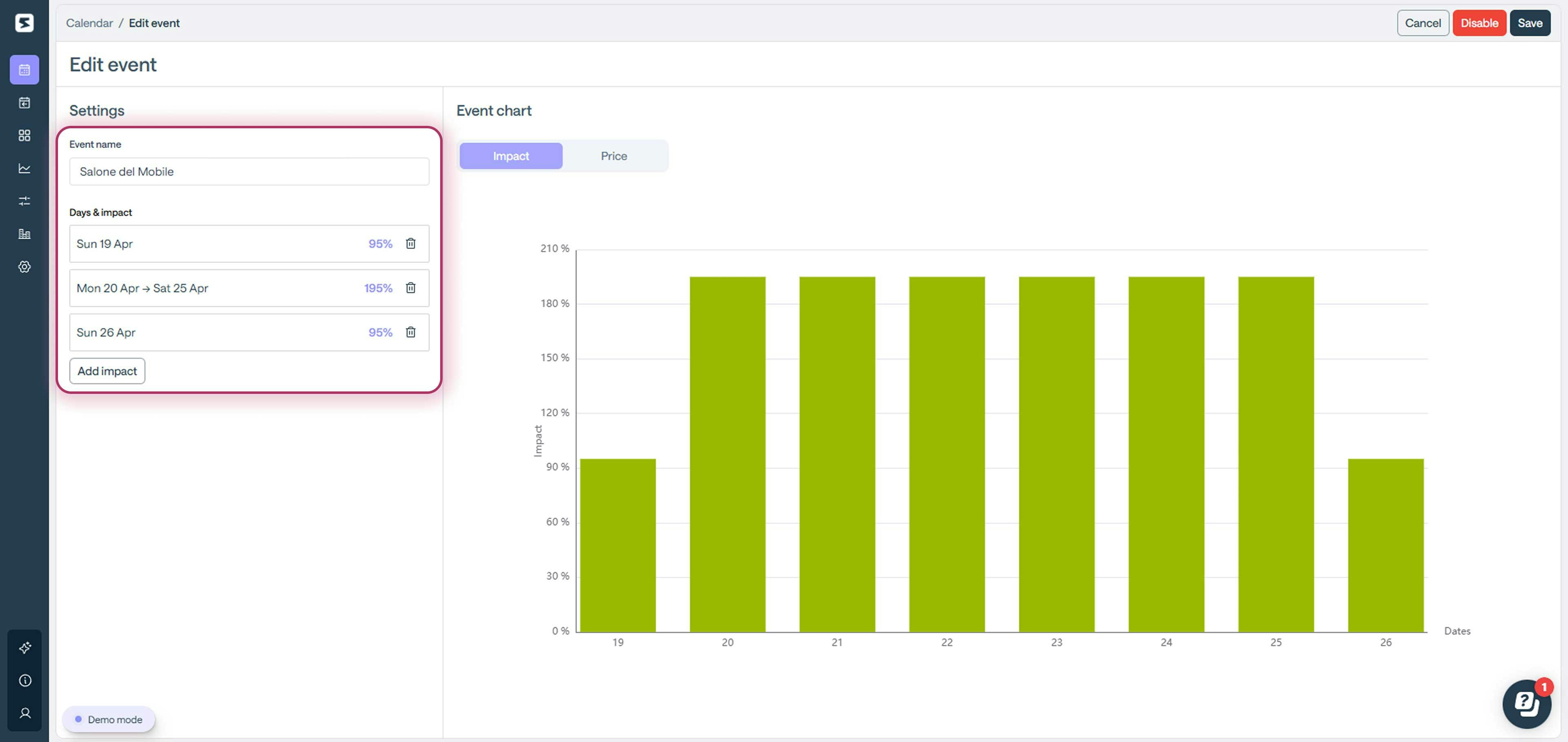

Practical example: how the Salone del Mobile impacts the hotel market between Milan and Monza

Take the Salone del Mobile, one of Milan’s most important international events. It attracts hundreds of thousands of visitors from all over the world and concentrates massive demand into just a few days.

In situations like this, the event’s impact isn’t limited to the central districts: it extends into nearby towns as well, although with varying intensity.

Four months before the event, Smartpricing is already estimating its impact.

In Milan, as shown in the screenshot, for the period between 20 and 25 April, the algorithm is already applying an estimated impact of +195%. These are the core days of the Salone. The days when market occupancy rises the fastest and available supply gets absorbed earliest.

In the days immediately before and after the main event (19 and 26 April), the impact drops to +95%, because arrivals and check-outs ease the pressure on demand.

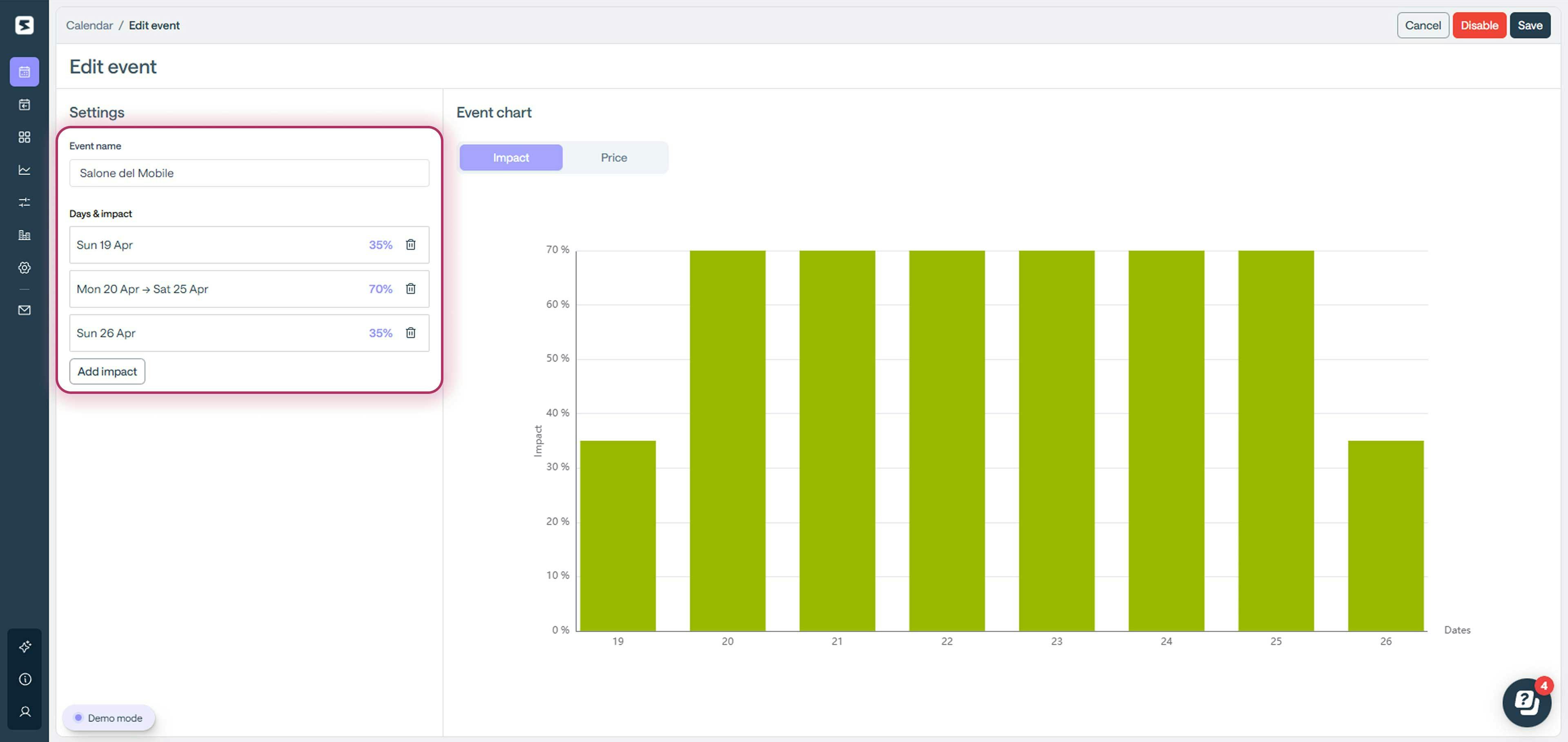

Monza, about a 30-minute drive from Milan, will still feel the effect, but to a lesser extent due to the distance. Here, demand will likely increase closer to the event, once availability in Milan begins to run out.

For this reason, the algorithm estimates an impact of +70% for Monza during the core days of the Salone, while in the opening and closing days the impact drops to around +35%.

The best part? Smartpricing automatically monitors events and holidays and uses this information to optimize your pricing strategy, while still giving you full control.

At any moment, you can review what the algorithm is doing, decrease or increase the impact of a specific event, remove it if it’s not relevant for you, or even add new ones.

Want to see how it works?

Request a personalized demo

Talk to a Smartness expert and discover how to automate your pricing strategy and increase your property’s revenue by an average of 30 percent. Free, no obligation.

Pricing strategy 2025: How to set the most profitable rates for your hotel

You don't need a crystal ball to predict next year's rates: here's how to do it.

Monitoring hotel competitors: How to analyze prices and occupancy

Find out what risks to avoid and how to create a truly competitive pricing strategy.